Artuitive serves as a platform on which Arthur and his team seek to acquire companies.

The Artuitive team has desired criteria for acquisition candidates:

Artuitive is a vehicle through which Arthur and his team incubates new business ideas and a platform on which to acquire and grow companies leveraging Artuitive’s marketing experience and finanical resources.

Mr. Shorin served as Chairman and CEO of The Topps Company, Inc., a trading card and confectionery business, from 1980 to 2007. During his tenure, the business grew from $60 million in sales to a worldwide enterprise generating profitable revenues well over $300 million. The business involves confectionery lines such as Bazooka Bubble Gum, Ring Pops, Push Pops, Baby Bottle Pops and a wide variety of collectible products, including Topps brand sports trading cards featuring professional athletes as well as pop culture iconics in film, music and games such as Pokemon. Mr. Shorin participated in the firm’s initial public offering in 1972 (American Stock Exchange), its leveraged buyout by Forstmann Little & Co in 1984 which resulted in record returns to investors, its second IPO (Nasdaq) in 1987 and, most recently, its acquisition by The Tornante Co, a private equity firm led by former Disney CEO Michael Eisner, in association with Madison Dearborn Partners, for $385 million.

After the most recent sale of The Topps Company, Arthur undertook to apply his considerable experience to a unique acquisition and growth model. Artuitive is both a vehicle through which Arthur and his team seek to incubate new business ideas and a platform on which to acquire and grow companies, particularly young ones.

In addition to his extensive commercial career, Arthur is a philanthropic New Yorker, having donated the Beverly and Arthur Shorin Music Performance Center at New York University, the Shorin Room at Carnegie Hall, the Shorin Comprehensive Transplant Center at New York Presbyterian Hospital, the Shorin Heart Transplant Center at the new Milstein Family Heart Hospital at NYPH and significant research projects at Cedars-Sinai Medical Center in Los Angles.

Besides chairing the Topps board, Arthur has served as a trustee of the Julliard School bringing increased focus on its branding activities and the board of Reprise Capital Corp.

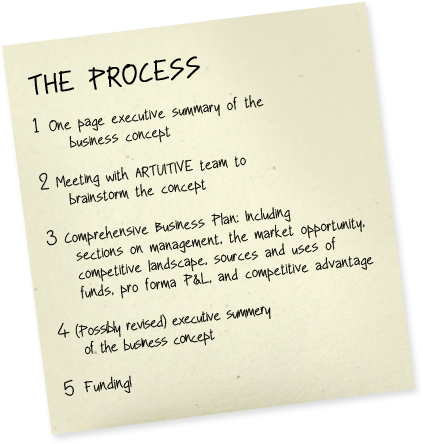

Artuitive endeavors to meet young designers at the top entreprenuial programs in the country with the intention of helping launch products that merit commercialization. The Artuitive team invites unique concepts and designs for such products. Bringing its business expertise to the table, the Artuitive team will work with the select entrants to shepherd their concepts to fruition and build businesses around them.

Selected entrants will have the option of entering into a licensing agreement with Artuitive and will receive $2,000 as an advance against future royalties. Artuitive will commit at that time to commercializing the product.

Artuitive serves as a platform on which Arthur and his team seek to acquire companies.

The Artuitive team has desired criteria for acquisition candidates:

Artuitive serves as a platform on which Arthur and his team seek to acquire companies.

Artuitive, a start-up itself, is prepared to incubate businesses spanning a variety of industries. From time to time, the group applies its expertise in assessing business opportunities and management teams through business plan competitions at college and business school campuses across the country.

Business plan submissions have touched a wide array of industries in Artuitive's first three years: unique product approaches to consumers, consumer promotion, humor and proprietary content.

Competitions have been completed at Harvard Business School, MIT Sloan, NYU Stern, Columbia Graduate School of Business, Wharton, Kellogg, and Baruch College.

All submissions should be protected by patent/copyright or effective means of protecting your property. Artuitive makes no representation relative confidentiality unless a formal nondisclosure (NDA) has been executed.

Artuitive is actively considering several early-stage businesses to add to its portfolio.

Current active investments include:

Arthur has assembled a team that brings a diverse set of experiences and expertise to the Artuitive brain trust. In assessing potential acquisitions or in evaluating new business ideas, each team member offers a unique perspective, independent of the others, that helps craft a well-rounded point of view on the concept, the market opportunity, the upside, the downside and the management.

Team member experience ranges from consumer products, entertainment & media, financial services and investment industries. Areas of know-how include strategy, marketing, product development, human resources administration, corporate finance and accounting, private equity and investing, manufacturing, production, distribution, and sourcing. The team has over a century of combined hands-on experience running businesses.

The network of the Artuitive team accesses insightful legal and financial counsel when appropriate.